Since the introduction of Binding Financial Agreements (BFAs) in Australia (know by some as prenups) many couples have chosen to enter into an agreement which sets out what will happen in the event of their separation as regards to property settlement and spousal maintenance.

I remind my clients that while hopefully the BFA will never be needed (because they will stay blissfully happy and never separate) they do have to be careful when making financial decisions as they need to take into account what the BFA says.

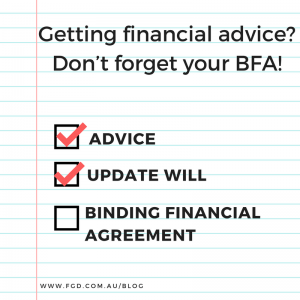

Therefore it is imperative that your accountant and any financial planner whom you engage has a copy of the Agreement so that they can give advice reflecting upon what will happen to that particular asset if you separate.

For example, a BFA might say that, upon separation, each party retains assets that are in their sole name and any jointly owned assets are divided equally. It may be that one party (Jack) is in a different tax bracket to the other (Jill) and so a financial planner suggests buying a share portfolio in Jill’s name. Notwithstanding that Jack might have paid for the purchase of the share portfolio, based on the prenup, Jill would retain the shares in the event of separation since they are in her sole name.

Similarly, if Jack and Jill purchased an investment property in joint names then upon separation the asset will be divided equally, even if Jack paid far more towards the purchase of that property than Jill. For smaller items such as furniture, this is not too troubling but couples who have a BFA cannot be casual about how assets are purchased during their time together and accountants and advisors should understand the effect of the BFA as well.

Ann Northcote is Family Lawyer at Farrar Gesini Dunn, Canberra Office.